Yuwan Duan, Zengkai Zhang*, Yuze Li, Shouyang Wang, Cuihong Yang, Yi Lu

Nature Climate Change

https://www.nature.com/articles/s41558-024-01952-0?utm_source=xmol&utm_medium=affiliate&utm_content=meta&utm_campaign=DDCN_1_GL01_metadata

Published: 28 March 2024

Abstract

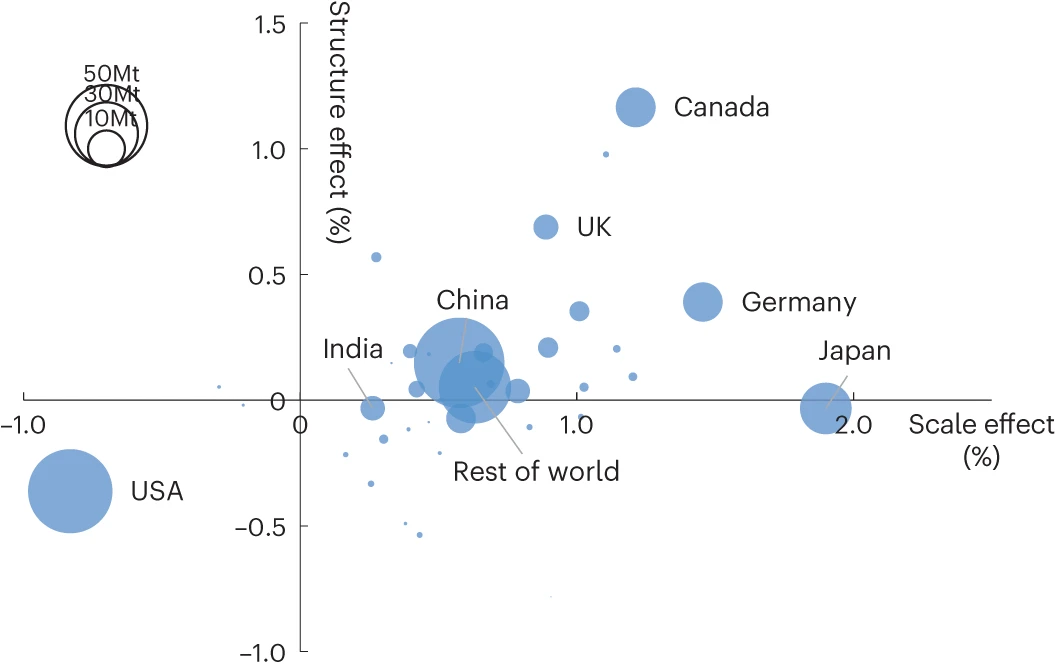

Many countries have cut their corporate tax rates in the past decades to attract foreign investment. To prevent this, a global minimum tax policy was approved by OECD countries in 2021. Global changes in corporate tax rates could reshape production and investment networks while impacting welfare and global emission patterns. Here we develop a theoretical multi-country multi-industry general equilibrium model and show that global corporate tax competition during 2005–2016 would increase global carbon emissions and shift more emissions to developing economies. Implementing a global minimum tax rate of 15% would reduce global carbon emissions and effectively decrease the developing economies’ emissions. The results highlight that corporate tax policies should be coordinated with climate regulations.